Multi-year bundles, usage-based pricing, and one-off commercial concessions have always been where quoting systems start to show their seams. In CPQ, teams learned to live with fake headers, duplicated products, and manual adjustments just to make a deal “look right.” Even in the early days of Revenue Cloud Advanced (RCA), ramping often meant structuring products differently upfront, adding admin overhead and forcing sellers to work around the system instead of with it.

That friction doesn’t just slow down quoting. It erodes forecast confidence. When a deal’s structure is hard to explain, leaders start questioning the numbers behind it, and finance spends more time normalizing data than trusting it.

The Winter ’26 release of RCA marks a meaningful shift. With quote line group ramping, Salesforce has removed several of the structural constraints that made ramped deals feel brittle. You can now model multi-year growth cleanly, keep the commercial story intact, and present a forecast that reflects how revenue actually ramps without turning the quote into a maze of line items.

What’s different is not just how you ramp, but where that logic lives. By leveraging quote line groups, RCA decouples ramping from product setup entirely. Any product—bundled, usage-based, or one-off—can be ramped without advance configuration. Sellers gain flexibility in the moment, admins avoid maintaining edge-case products, and finance gets a cleaner, more consistent data model downstream.

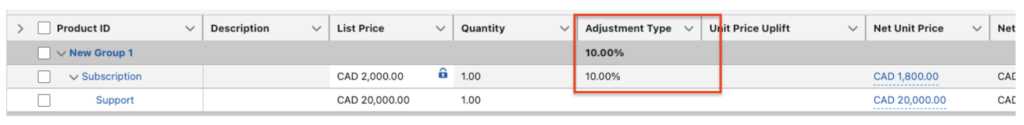

Even better, group-level adjustments allow you to apply discounts across an entire year or ramp period in just a few clicks with Group Adjustment type. That means fewer manual overrides, fewer reconciliation headaches, and far fewer “adjustment deals” showing up late in the forecast.

To us, this update was a signal that Salesforce is moving ramped deals out of workaround territory and into a first-class revenue pattern; one that supports clear forecasting, fewer surprises, and more confident decision-making as deals scale over time.

Here’s how this works:

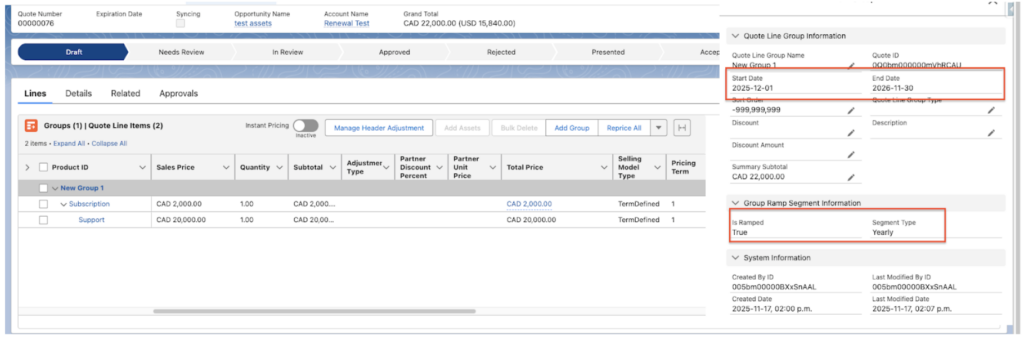

- Add your relevant quote lines to your quote from the catalog

- Add a group to the Quote

- Open your newly created group and set the start and end dates and check the Is Ramped Checkbox

- Your newly created group is now ramped for 1 year and all the line items in the group will follow the groups start and end dates.

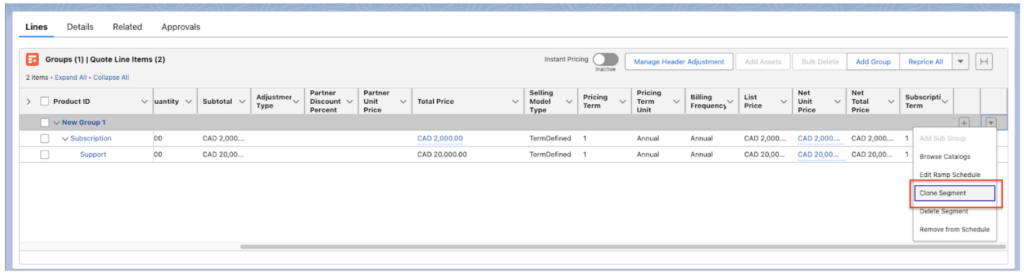

- In order to increase the number of years you can now clone the segment. This will create a new group for a second year, you can then clone that for a new segment for year 3 and so on.

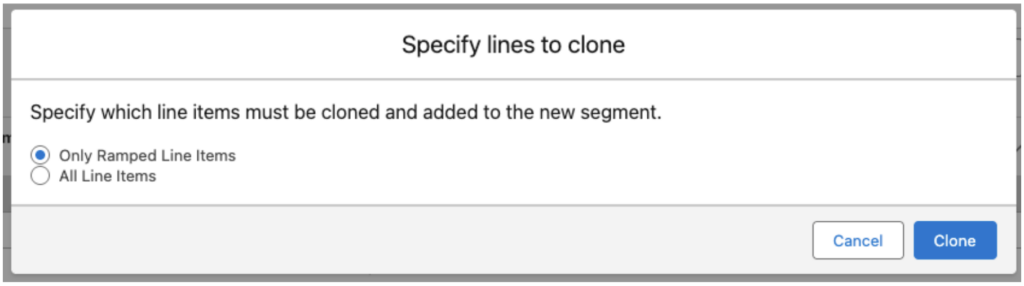

- When Cloning your segments you will be asked if you want to include only the ramped Line Items or all line items. Selecting only ramped line items will exclude things like one time products from being brought over into the new segment.

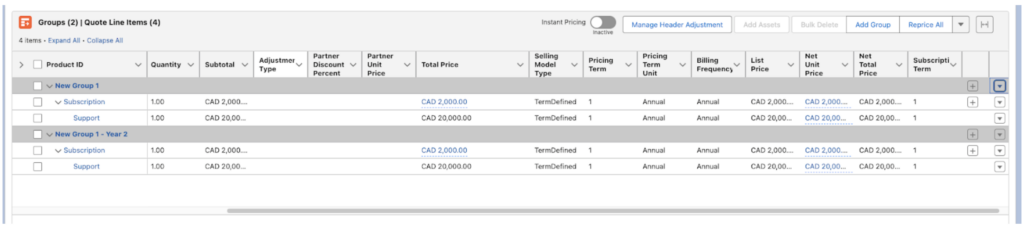

- Final product is something like this:

One thing to note: You’ll need to be using the new Sales Transaction Line Editor (LWC) and have Ramp Deals for Groups enabled in Revenue Settings for this to work.

At this point, you’ve created a ramped deal and are ready to move it forward, but there are a few more features worth highlighting that make this tool especially powerful.

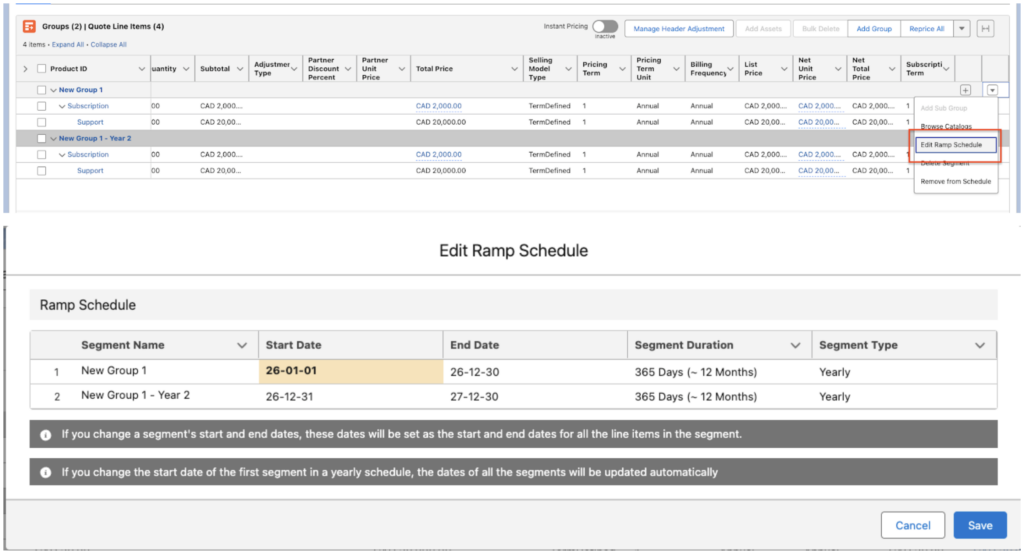

Editing Ramp Schedules

Ramped deals aren’t locked in stone. If you need to adjust timing, simply select Edit Ramp Schedule. From there, you can update the start date of the first ramp segment, and RCA will automatically recalculate the start and end dates for all subsequent segments. No manual rework, no downstream cleanup.

Bundle Behaviour Across Ramp Terms

RCA handles bundle changes in a way that aligns with how deals actually evolve over time:

- Quantity changes apply to the current term and all future terms, ensuring volume-based growth stays consistent.

- Configuration and attribute changes are applied across all ramp terms, preserving bundle integrity year over year.

This strikes a balance between flexibility for sellers and predictability for operations.

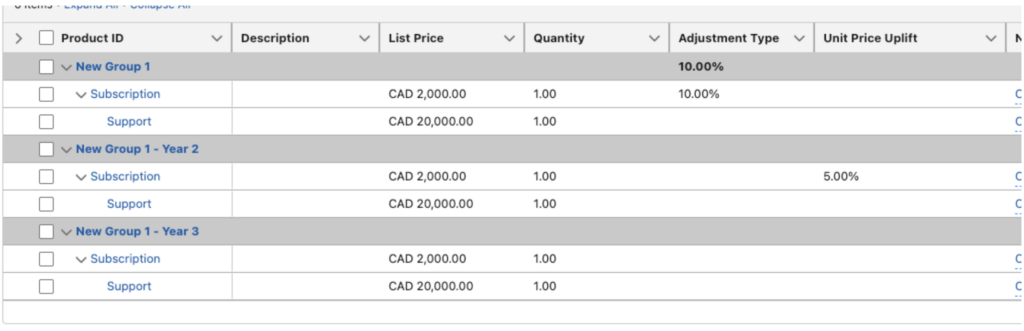

Uplift Considerations

Group ramp deals do support uplift, but with a few important nuances:

- Uplift does not automatically carry forward to future ramp terms.

- Uplift is not compounded by default and must be applied manually per term if required.

This makes uplift behaviour explicit rather than assumed, which is critical for avoiding forecast surprises later in the deal lifecycle.

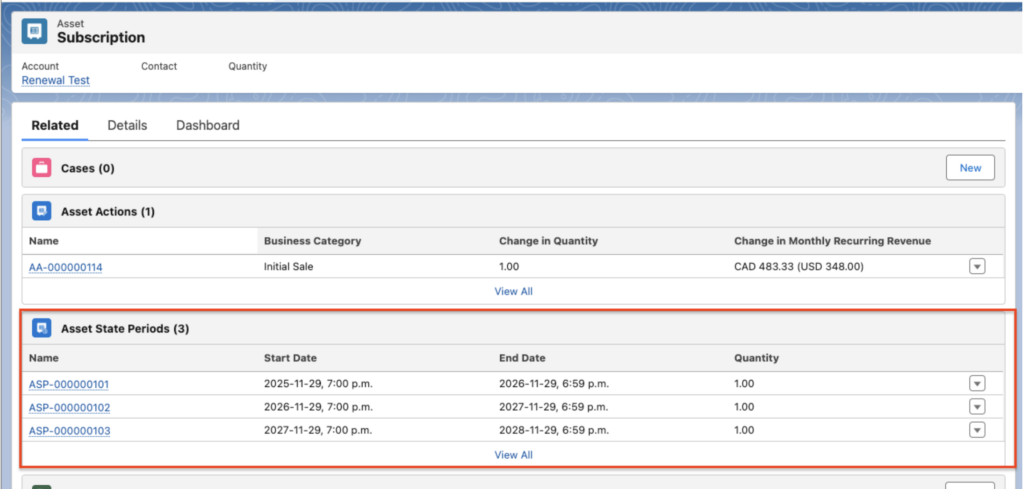

Downstream Impact: Orders, Contracts, and Assets

Downstream processing follows the standard RCA flow: create the order, generate the contract, and activate to produce assets. The key difference shows up at asset creation.

Instead of generating a separate asset for each ramp year, RCA creates:

- One asset per product, with

- Multiple related asset state periods representing each ramp term.

The result is a far cleaner asset model that’s easier to understand on the account and contract, simpler to manage operationally, and far more scalable as ramped deals become the norm.

Ramped deals have always existed in theory, but until recent months, they’ve involved more of a lift to execute cleanly at scale. What quote line group ramping in RCA finally delivers is alignment: sellers can tell a clear commercial story, finance can trust what shows up in the forecast, and operations no longer has to reverse-engineer intent from a cluttered quote.

This isn’t just about making ramping easier. It’s about making it predictable. When ramp logic lives at the right level, adjustments are intentional, downstream data stays clean, and leadership can focus on decisions instead of reconciliations.

If ramped growth is part of how your business sells (and for most scaling companies, it is) this update moves RCA much closer to supporting how revenue actually behaves. Fewer workarounds. Fewer surprises. And far more confidence as deals ramp, year after year. Want ramped deals that work for sellers and hold up with finance and leadership? Let’s chat.